The Pradhan Mantri Employment Generation Programme (PMEGP) is a government initiative aimed at promoting self-employment and entrepreneurship in India. This scheme provides financial assistance to individuals looking to start their own businesses, thereby contributing to the economy and creating job opportunities. One crucial aspect of this scheme is the application process, particularly the last date to apply for the PMEGP loan online, which aspiring entrepreneurs must be aware of.

In today's fast-paced world, where digital transformation is at its peak, the ability to apply for loans online has made life significantly easier for many. The PMEGP loan apply online last date is something that potential applicants should keep a close eye on, as missing it could mean delaying their entrepreneurial dreams. Therefore, understanding the nuances of the application process and the deadlines involved is essential for anyone interested in benefiting from this program.

With the government keen on promoting small businesses and entrepreneurship, the PMEGP scheme has witnessed a surge in applications. However, it is important for applicants to stay informed about the PMEGP loan apply online last date, as this will allow them to prepare their documents and submit their applications on time. In this article, we will explore various aspects of the PMEGP loan application process, including eligibility criteria, the application procedure, and the significance of the last date for submission.

Read also:Happy Hippo The Cheerful Creature Of The Animal Kingdom

What is the PMEGP Loan?

The PMEGP loan is a financial assistance scheme initiated by the Government of India to support self-employment and entrepreneurship. It aims to provide loans to individuals who want to start small businesses, thus contributing to the overall economic development of the country. The loans can be used for various purposes, including purchasing equipment, raw materials, and meeting operational costs.

Who is Eligible to Apply for the PMEGP Loan?

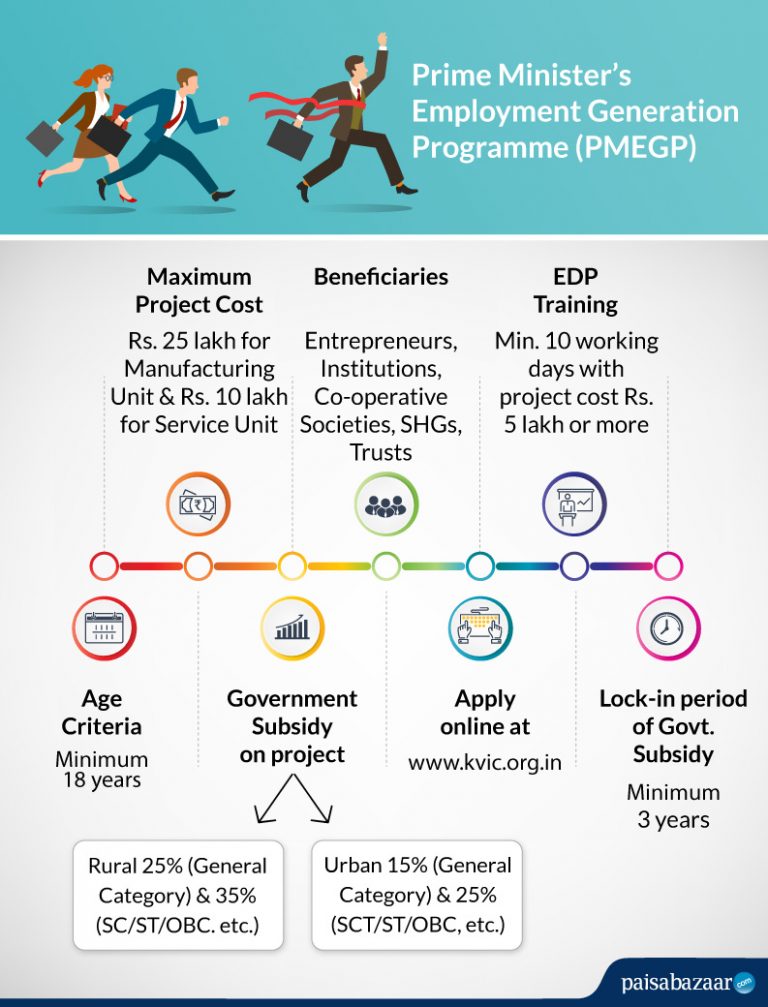

Eligibility criteria for the PMEGP loan are designed to ensure that the benefits reach deserving candidates. Here are the primary eligibility requirements:

- Applicants must be at least 18 years old.

- Educational qualifications vary based on the type of business.

- Individuals from SC/ST/OBC/Women/Minority communities are given preference.

- Existing businesses can also apply for expansion funds.

Why is the PMEGP Loan Important for Entrepreneurs?

The PMEGP loan is significant for several reasons:

- It provides financial support to aspiring entrepreneurs.

- It encourages self-employment and reduces unemployment.

- It fosters economic growth and development in rural and semi-urban areas.

- It offers lower interest rates compared to traditional loans.

How to Apply for the PMEGP Loan Online?

The application process for the PMEGP loan is straightforward. Here’s how you can apply online:

- Visit the official PMEGP website.

- Register yourself by filling in the necessary details.

- Fill out the application form with accurate information.

- Upload the required documents.

- Submit the application before the last date.

What Documents Are Required for PMEGP Loan Application?

When applying for the PMEGP loan, you need to prepare the following documents:

- Identity proof (Aadhar card, PAN card, etc.)

- Address proof (Utility bills, rental agreement, etc.)

- Educational qualification certificates.

- Business project report detailing the business plan.

- Passport-sized photographs.

When is the PMEGP Loan Apply Online Last Date?

The PMEGP loan apply online last date varies depending on the financial year and the announcement made by the Ministry of MSME. It is crucial to check the official PMEGP website or local KVIC office for the most accurate and up-to-date information regarding the application deadline. Missing this date could mean waiting for the next financial year to apply again.

Read also:Zero Tolerance A Comprehensive Guide To Understanding And Implementing Policies

What Happens if You Miss the Last Date for PMEGP Loan Application?

If you miss the PMEGP loan apply online last date, here are a few things that may happen:

- You will have to wait until the next application cycle to submit your application.

- Your business plans may be delayed, affecting your overall goals.

- You may lose out on potential financial assistance that could help you start your business.

How to Stay Updated About PMEGP Loan Application Dates?

To stay informed about the PMEGP loan apply online last date and other important announcements, consider the following methods:

- Regularly check the official PMEGP website.

- Follow relevant social media pages and groups.

- Subscribe to newsletters or notifications from the Ministry of MSME.

- Contact local KVIC or DIC offices for updates.

Conclusion: The Importance of Timely Application for PMEGP Loans

In conclusion, the PMEGP loan is a valuable opportunity for aspiring entrepreneurs looking to start their own businesses. Being aware of the PMEGP loan apply online last date is essential to ensure that you do not miss out on this financial assistance. By following the application process diligently and preparing the necessary documents ahead of time, you can enhance your chances of securing the loan and taking a significant step toward your entrepreneurial dreams.