The PMEGP (Prime Minister's Employment Generation Programme) is a flagship scheme aimed at promoting entrepreneurship and generating self-employment opportunities in India. It plays a crucial role in boosting the economy by providing financial assistance to small businesses and startup ventures. However, navigating through the PMEGP loan rules can be a daunting task for many aspiring entrepreneurs. This article aims to break down the essential rules and guidelines associated with obtaining a PMEGP loan, ensuring that you are well-informed and prepared to take advantage of this beneficial program.

The PMEGP loan offers a golden opportunity for individuals looking to establish their own businesses. This scheme is particularly beneficial for marginalized sections of society, including women, Scheduled Castes, and Scheduled Tribes. By understanding the PMEGP loan rules, applicants can enhance their chances of securing funding and successfully launching their ventures. In this guide, we will delve into the various aspects of the PMEGP loan, including eligibility criteria, application procedures, and more.

As the entrepreneurial landscape continues to evolve, the PMEGP scheme remains a vital resource for many. It is essential to be well-versed in the PMEGP loan rules to avoid common pitfalls and maximize the benefits available under the scheme. Whether you are a first-time applicant or someone looking to expand an existing business, this guide will equip you with the knowledge you need to navigate the PMEGP landscape effectively.

Read also:Ultimate Guide To Naming Cars With Name Car Generator

What is the PMEGP Loan?

The PMEGP loan is a credit scheme launched by the Ministry of Micro, Small, and Medium Enterprises (MSME) in India. Its primary goal is to promote self-employment by providing financial assistance to entrepreneurs. The scheme is implemented through banks and financial institutions, which offer loans at subsidized interest rates. The PMEGP loan is designed for small businesses and startups, enabling them to cover various expenses such as equipment purchases, working capital, and operational costs.

Who is Eligible for a PMEGP Loan?

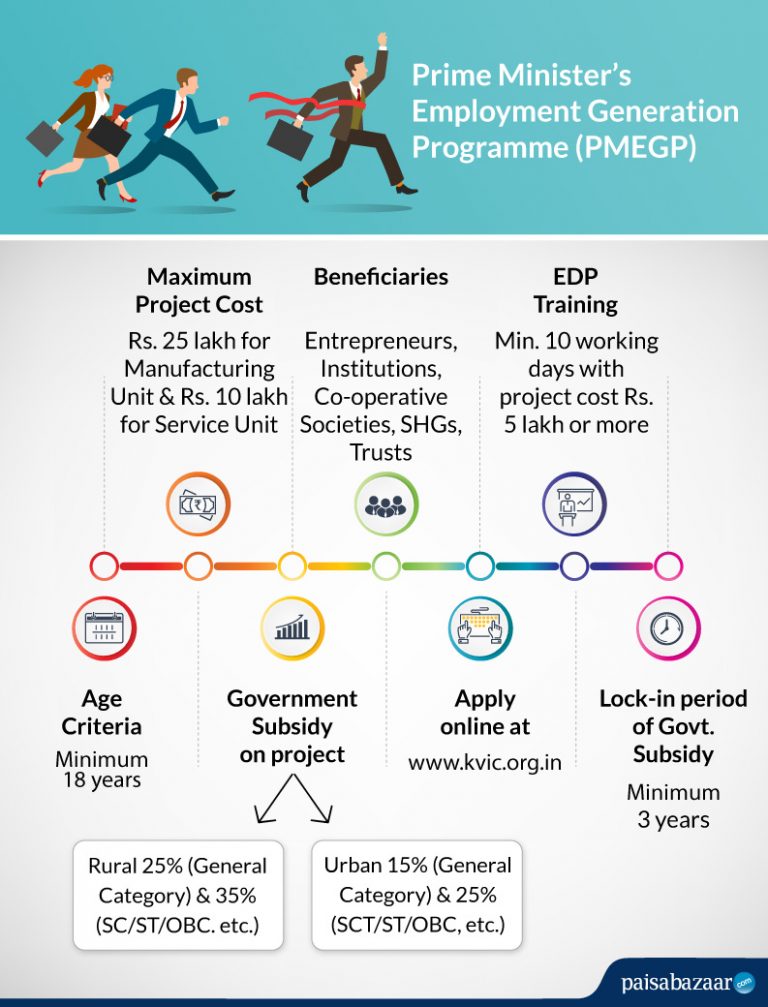

Eligibility for a PMEGP loan is determined by several factors, including age, educational qualifications, and type of business. Here are the primary eligibility criteria:

- Applicants must be at least 18 years old.

- Individuals or groups can apply; self-help groups (SHGs) and co-operatives are also eligible.

- An educational qualification of at least the 8th standard is required.

- The business must be in the manufacturing or service sector.

- Those who have previously availed of a subsidy under any other scheme are not eligible.

What are the Key PMEGP Loan Rules?

Understanding the PMEGP loan rules is crucial for a successful application. Here are some of the key rules that applicants must be aware of:

1. Loan Amount

The loan amount varies based on the type of business and the applicant's eligibility. The maximum loan amount is:

- For manufacturing units: ₹25 lakhs

- For service units: ₹10 lakhs

2. Subsidy Percentage

The PMEGP scheme offers a subsidy on the loan amount, which is determined based on the applicant's category:

- General category: 15%

- Scheduled Castes, Scheduled Tribes, and women: 25%

- North Eastern Region: 34%

3. Repayment Period

The repayment period for PMEGP loans typically ranges from 3 to 7 years, depending on the terms set by the lending institution.

Read also:Ultimate Guide To Secure Verification Phone Number

4. Interest Rates

The interest rates for PMEGP loans are generally lower than market rates, making it an attractive option for entrepreneurs. Rates can vary between 8% to 12% per annum, depending on the financial institution.

How to Apply for a PMEGP Loan?

Applying for a PMEGP loan involves a systematic process. Here are the steps to follow:

- Determine your eligibility based on the criteria outlined above.

- Prepare a detailed project report outlining your business plan, financial requirements, and projected outcomes.

- Visit a nearby bank or financial institution that is authorized to process PMEGP loans.

- Submit your application along with the required documents, including identity proof, address proof, and educational qualifications.

- Once your application is approved, you will receive the loan amount to start or expand your business.

What Documents are Required for a PMEGP Loan?

When applying for a PMEGP loan, it's essential to have the following documents ready:

- Identity proof (Aadhar card, passport, voter ID, etc.)

- Address proof (utility bills, rental agreements, etc.)

- Educational qualifications and experience certificates.

- Project report detailing the business plan and financial projections.

- Bank account statement for the last six months.

What are the Common Challenges in Availing PMEGP Loans?

While the PMEGP loan scheme offers numerous benefits, applicants may face certain challenges:

- Complexity in preparing a comprehensive project report.

- Strict eligibility criteria that may disqualify some applicants.

- Long processing times leading to delays in funding.

Conclusion: Maximizing Your Chances of Securing a PMEGP Loan

In conclusion, the PMEGP loan rules provide a valuable framework for aspiring entrepreneurs looking to start or expand their businesses. By understanding these rules and preparing thoroughly, applicants can significantly enhance their chances of securing financial assistance. It is essential to focus on creating a solid business plan, gathering necessary documentation, and adhering to the guidelines set forth by the PMEGP scheme. Embracing these steps will pave the way for entrepreneurial success and contribute to the overall economic growth of the nation.