The Paycheck Protection Program (PPP) was a lifeline for many businesses during the challenging times of the COVID-19 pandemic. It aimed to provide financial assistance to small businesses across the United States, helping them to maintain their workforce and avoid layoffs. As part of this initiative, the PPP loan list of names has become a vital resource for understanding how these funds were distributed and which businesses received support. The significance of this list extends beyond mere numbers; it reveals the stories of resilience and recovery among American entrepreneurs. In a time of economic uncertainty, the PPP loan list of names shines a light on those who took the necessary steps to safeguard their businesses and employees.

The PPP loan program was designed to quickly distribute funds to eligible businesses, but as the program progressed, transparency became a pressing concern. The public release of the PPP loan list of names allowed individuals and organizations to scrutinize the allocation of funds and ensure that assistance reached those who genuinely needed it. This has fostered a greater understanding of the program's impact on various sectors, from hospitality to retail, and everything in between.

In this article, we will delve into the PPP loan list of names, exploring the various aspects of the program and its beneficiaries. From understanding the criteria for loan approval to examining the implications of the program on the economy, we will provide a comprehensive overview of this pivotal initiative. Join us as we uncover the stories behind the PPP loan list of names and what they signify for the future of American businesses.

Read also:Discovering The Legacy Of Carlos Obrien An Indepth Exploration

What is the PPP Loan Program?

The Paycheck Protection Program was introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020. Its primary goal was to assist small businesses in navigating the financial challenges posed by the pandemic. Here are some key features of the PPP loan program:

- Loans were available to small businesses, self-employed individuals, and certain nonprofit organizations.

- The program provided forgivable loans to cover payroll costs, rent, utilities, and other essential expenses.

- Businesses could apply for loans up to 2.5 times their average monthly payroll expenses, with a maximum limit of $10 million.

- To qualify for forgiveness, businesses needed to maintain their employee headcount and salary levels.

Who Made the PPP Loan List of Names?

The PPP loan list of names encompasses a diverse range of businesses that applied for and received funding. This list is a testament to the widespread impact of the program, with recipients including:

- Restaurants and cafes struggling with reduced foot traffic.

- Retail stores that faced closures and declining sales.

- Service providers, such as salons and fitness studios, that were forced to shut down.

- Freelancers and independent contractors who experienced a significant loss of income.

What Criteria Were Used for PPP Loan Approval?

Understanding the criteria for loan approval is essential for grasping how the PPP loan list of names was compiled. Some of the primary requirements included:

- Businesses had to have 500 or fewer employees.

- Applicants needed to demonstrate that they were operational as of February 15, 2020.

- Documentation of payroll expenses, including tax filings and employee counts, was necessary.

- Businesses had to certify that the funds would be used for eligible expenses and that they were in need of the loan due to economic uncertainty.

How Was the PPP Loan List of Names Compiled?

The compilation of the PPP loan list of names involved several steps. The Small Business Administration (SBA) worked alongside financial institutions to process loan applications and disburse funds. Key aspects of the compilation process included:

- Financial institutions collected data on businesses that applied for loans.

- The SBA compiled and verified this data before releasing it to the public.

- Data included the names of recipients, loan amounts, and the number of jobs supported.

What Impact Did the PPP Loan Program Have on Businesses?

The impact of the PPP loan program on businesses has been profound. Many companies were able to retain employees and avoid layoffs thanks to the financial support provided. However, the program was not without its challenges. Some businesses faced delays in receiving funds, while others struggled to navigate the application process. Here are some notable impacts:

- Many businesses were able to pivot their operations, adopting new practices to adapt to changing market conditions.

- The program helped prevent widespread unemployment, stabilizing the economy during a critical period.

- Some businesses used the funds to innovate and expand their offerings in response to shifting consumer demands.

Are There Any Controversies Surrounding the PPP Loan List of Names?

While the PPP loan list of names has provided valuable insights, it has also sparked controversies. Issues surrounding the distribution of funds raised questions about fairness and equity. Key controversies include:

Read also:Furries People A Unique Subculture In Modern Society

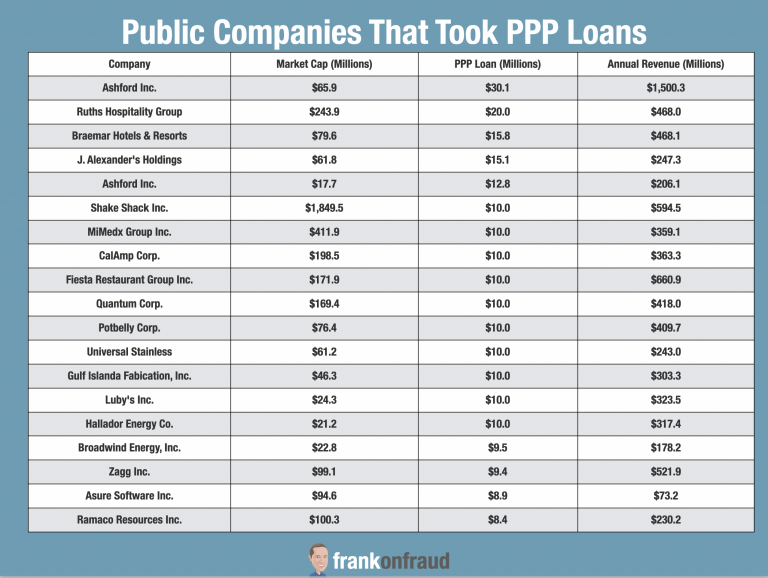

- Some larger businesses received significant funding, raising concerns about the program's original intent to support small businesses.

- The transparency of the approval process has been questioned, leading to calls for more accountability.

- Reports of fraudulent applications for loans have surfaced, prompting investigations into misuse of funds.

What Can Be Learned from the PPP Loan List of Names?

The PPP loan list of names serves as both a record of financial assistance and a learning tool for future initiatives. Here are some key takeaways:

- The importance of swift, accessible funding during crises cannot be overstated.

- Transparency in funding distribution is crucial for public trust and accountability.

- Future programs can benefit from the lessons learned regarding eligibility criteria and application processes.

Conclusion: The Legacy of the PPP Loan List of Names

The PPP loan list of names is more than just a compilation of data; it represents the stories of countless businesses that faced unprecedented challenges during the pandemic. As we reflect on the program's impact, it is essential to acknowledge both its successes and shortcomings. The lessons learned from this initiative can guide future efforts to support small businesses in times of crisis. Ultimately, the PPP loan list of names reminds us of the resilience of the American spirit and the importance of community support during challenging times.