In today's fast-paced world, financial needs can arise unexpectedly, and having access to quick and reliable funding is essential. The HDFC Bank Personal Loan App is designed to meet these needs with convenience and efficiency. This innovative application allows users to apply for personal loans from the comfort of their homes, eliminating the need for lengthy paperwork and long waiting times. With just a few taps on their smartphones, customers can navigate through the loan application process seamlessly, making financial assistance more accessible than ever.

The HDFC Bank Personal Loan App caters to a wide range of personal financing requirements, whether it's for medical emergencies, education, travel, or home renovations. Through the app, users can enjoy personalized offers tailored to their financial profiles, ensuring that they secure the best possible loan terms. Moreover, the app is designed with user-friendliness in mind, allowing both tech-savvy individuals and those less familiar with technology to navigate its features effortlessly.

In this article, we will delve deeper into the features, benefits, and process of obtaining a loan through the HDFC Bank Personal Loan App. We will answer some common questions that potential borrowers might have, helping you to make an informed decision about whether this app is the right financial tool for you. Join us as we explore the ins and outs of the HDFC Bank Personal Loan App, and discover how it can help you achieve your financial goals.

Read also:Location Of Oxford University A Comprehensive Guide

What Features Does the HDFC Bank Personal Loan App Offer?

The HDFC Bank Personal Loan App is equipped with a variety of features that enhance the user experience. Here are some key offerings:

- Instant loan approval and disbursement

- User-friendly interface

- Personalized loan offers based on credit profile

- Real-time loan tracking

- Access to pre-approved loans

- Easy EMI calculator for financial planning

- Secure document upload and verification process

How to Apply for a Personal Loan Using the HDFC Bank Personal Loan App?

Applying for a personal loan through the HDFC Bank Personal Loan App is a straightforward process. Here’s a step-by-step guide:

- Download the HDFC Bank Personal Loan App from the App Store or Google Play Store.

- Create an account or log in if you already have one.

- Fill in the required personal and financial details.

- Upload necessary documents for verification.

- Review the loan offers presented to you.

- Select your preferred loan amount and tenure.

- Submit your application for approval.

What Documents Are Required for Applying via the HDFC Bank Personal Loan App?

To ensure a smooth application process, applicants should have the following documents ready:

- Identity proof (Aadhaar card, passport, etc.)

- Address proof (utility bill, rental agreement, etc.)

- Income proof (salary slips, bank statements, etc.)

- Employment proof (offer letter, experience letter, etc.)

What Are the Benefits of Using the HDFC Bank Personal Loan App?

The HDFC Bank Personal Loan App offers numerous advantages that make it a preferred choice for many borrowers:

- Convenience of applying anytime, anywhere

- Quick loan disbursal

- Competitive interest rates

- Flexible repayment options

- Real-time updates on application status

- Access to exclusive offers and promotions

Is the HDFC Bank Personal Loan App Safe and Secure?

Yes, the HDFC Bank Personal Loan App prioritizes user security. The app employs robust encryption technologies to protect sensitive information. Additionally, the app complies with all regulatory standards to ensure that user data is handled responsibly.

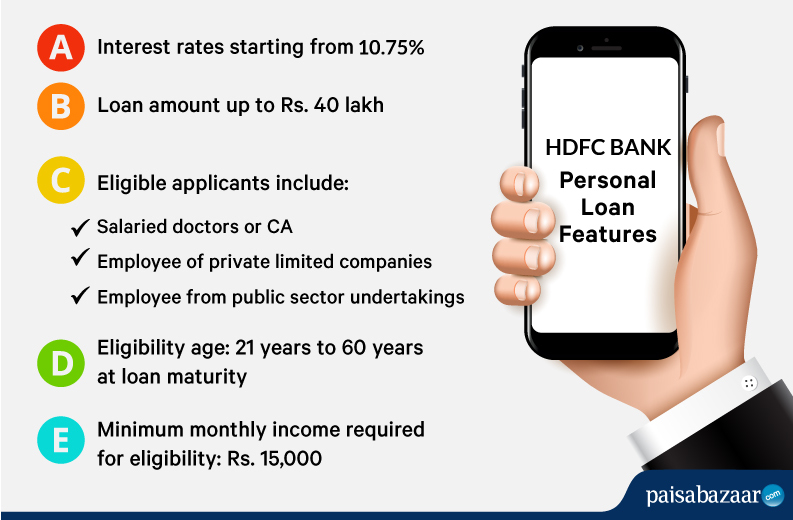

What Is the Eligibility Criteria for a Personal Loan Through the HDFC Bank Personal Loan App?

The eligibility criteria for applying for a personal loan through the HDFC Bank Personal Loan App generally include:

Read also:The Exciting World Of High 5 Casino A Comprehensive Guide

- A minimum age of 21 years

- A maximum age of 60 years at loan maturity

- Stable monthly income (varies based on the loan amount)

- Good credit score (usually above 750)

Can Existing HDFC Bank Customers Benefit More from the Personal Loan App?

Absolutely! Existing HDFC Bank customers may enjoy pre-approved loan offers, making the application process even quicker and more streamlined. Additionally, they may have access to better interest rates and loan terms due to their established relationship with the bank.

Conclusion: Is the HDFC Bank Personal Loan App Right for You?

In conclusion, the HDFC Bank Personal Loan App stands out as a reliable and efficient tool for those seeking quick financial assistance. With its user-friendly interface, competitive interest rates, and a plethora of features designed for customer convenience, it can be an excellent choice for both existing customers and new applicants alike. Whether dealing with an emergency, planning a trip, or pursuing higher education, the HDFC Bank Personal Loan App is equipped to help you meet your financial goals.