The Vaya Vandana Yojana is a government-backed pension scheme designed specifically for senior citizens in India. It aims to provide a steady income stream to the elderly population, ensuring they have financial security during their retirement years. One of the key components of this scheme is the interest rate, which plays a crucial role in determining the benefits accrued by the participants. In this article, we will explore the intricacies of the Vaya Vandana Yojana interest rate, its significance, and how it impacts the overall returns for the investors.

As India continues to witness a demographic shift with an increasing elderly population, schemes like the Vaya Vandana Yojana become essential in safeguarding their financial future. The interest rate offers an attractive return on investment, making it an appealing option for those looking to secure a stable income after retirement. Furthermore, understanding how this interest rate is set and adjusted can empower potential investors to make informed decisions regarding their retirement savings.

In addition to the interest rate, the Vaya Vandana Yojana encompasses various features and benefits that cater specifically to senior citizens. This article will delve into the specifics of the interest rate, its benefits, and the eligibility criteria for potential applicants. By the end of this article, you will have a comprehensive understanding of the Vaya Vandana Yojana interest rate and how it can serve as a reliable source of income during your golden years.

Read also:Ultimate Dining Experience At Ceviche 105 Miami

What is the Vaya Vandana Yojana?

The Vaya Vandana Yojana is a pension scheme launched by the Government of India in 2017. It is specially designed for senior citizens aged 60 years and above. The scheme allows them to invest a lump sum amount and receive a regular pension for a specified period, ensuring their financial independence during retirement.

How is the Vaya Vandana Yojana Interest Rate Determined?

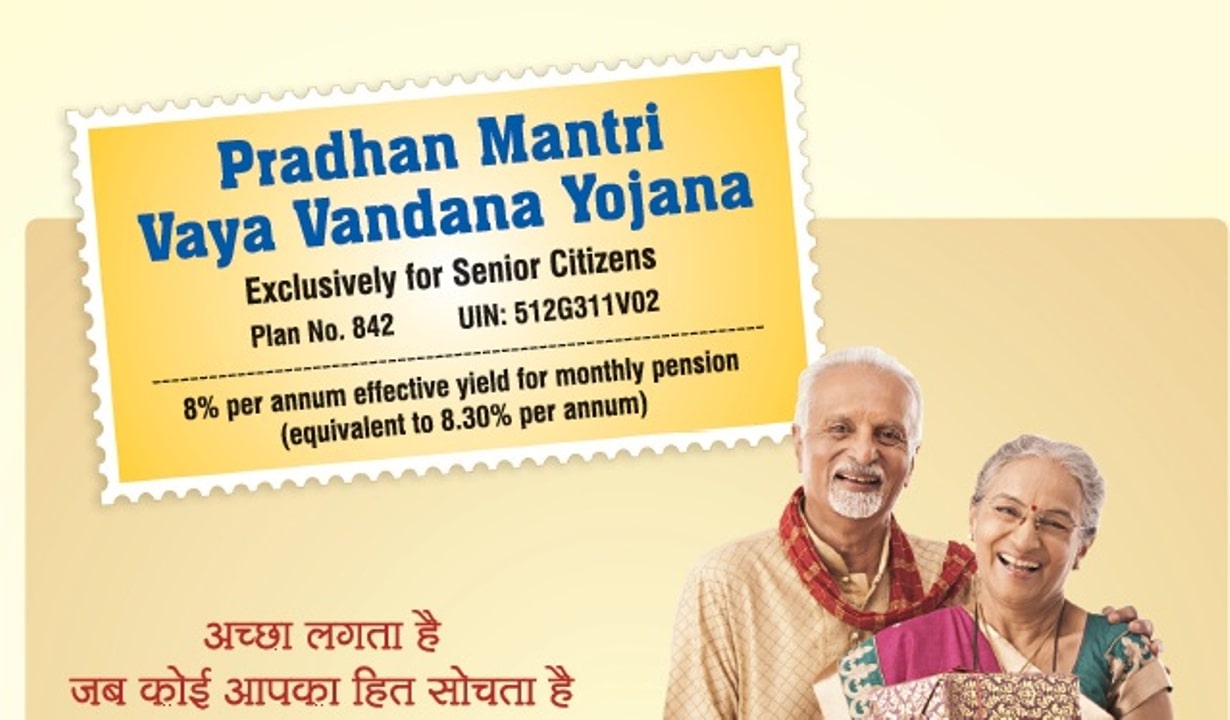

The interest rate for the Vaya Vandana Yojana is determined by the government and is subject to periodic revision. It is aligned with prevailing market conditions and aims to offer attractive returns to investors. The interest rate is generally announced at the beginning of each financial year and may vary based on economic factors.

What is the Current Vaya Vandana Yojana Interest Rate?

As of the latest updates, the Vaya Vandana Yojana interest rate is set at 7.40% per annum. This attractive rate ensures that participants receive a decent return on their investment while enjoying the benefits of a guaranteed pension.

What are the Benefits of the Vaya Vandana Yojana Interest Rate?

- Guaranteed Returns: The interest rate ensures a fixed return on the investment, providing financial security to senior citizens.

- Income for Life: Participants receive a regular monthly pension, which can help cover living expenses during retirement.

- Life Insurance Cover: In case of the unfortunate demise of the investor, the nominee receives the investment amount, providing additional financial support.

- Tax Benefits: The amount invested in the scheme is eligible for tax deductions under Section 80C of the Income Tax Act.

How to Apply for the Vaya Vandana Yojana?

Applying for the Vaya Vandana Yojana is a straightforward process. Interested individuals can visit the nearest Life Insurance Corporation (LIC) branch or the official LIC website to obtain the application form. Here are the steps to follow:

- Download the application form or visit an LIC branch.

- Fill in the required details in the form.

- Submit the form along with necessary documents, including age proof and identity proof.

- Make the initial investment as per the scheme guidelines.

Who is Eligible for the Vaya Vandana Yojana?

The Vaya Vandana Yojana is available to all Indian citizens aged 60 years and above. Additionally, applicants must meet the following criteria:

- Must be a resident of India.

- Must have a valid identity proof and age proof.

- Investment limit should be between a minimum of Rs. 1.5 lakh and a maximum of Rs. 15 lakh.

What are the Terms and Conditions of the Vaya Vandana Yojana?

Before investing in the Vaya Vandana Yojana, it is essential to understand the terms and conditions:

Read also:Mastering Microsoft Word How To Delete A Page In Word Effortlessly

- The scheme has a tenure of 10 years.

- The monthly pension is paid on a monthly, quarterly, half-yearly, or yearly basis.

- The scheme allows premature exit under certain conditions, with a deduction in the principal amount.

Can the Vaya Vandana Yojana Interest Rate Change Over Time?

Yes, the Vaya Vandana Yojana interest rate can change over time. The government reviews the rate periodically based on economic factors such as inflation and market conditions. It is advisable for investors to stay updated on any changes to maximize their returns.

Conclusion

In summary, the Vaya Vandana Yojana interest rate is a pivotal element of this government-sponsored pension scheme aimed at ensuring financial stability for senior citizens. Offering an attractive return and numerous benefits, it serves as a reliable option for those seeking a secure income during their retirement years. With the current interest rate set at 7.40%, now is an opportune time for eligible individuals to consider investing in this scheme and enjoy the peace of mind it offers.