The Pradhan Mantri Vaya Vandana Yojana (PMVVY) is a government-backed pension scheme designed to provide financial security to senior citizens in India. One of the most crucial aspects of this scheme is the PMVVY interest rate, which determines the returns that beneficiaries can expect. This article delves into the intricacies of the PMVVY interest rate, outlining its significance, how it is calculated, and the benefits it offers to retirees. Senior citizens often face financial uncertainties after retirement, making a reliable source of income essential. PMVVY aims to address these concerns by providing a fixed interest rate that ensures a steady income for the elderly. This scheme not only offers a safety net for retirees but also encourages them to invest their savings wisely.

Understanding the PMVVY interest rate involves recognizing how it influences the overall pension amount received by beneficiaries. The government periodically reviews this rate, which can be affected by various economic factors, including inflation and market trends. Therefore, it's important for potential investors to stay informed about any changes that may occur over time. In this article, we will explore the various features of PMVVY, including its eligibility criteria, investment limits, and the application process, ensuring that readers have a thorough understanding of the scheme.

As we delve deeper into the topic, we will address common questions surrounding the PMVVY interest rate, such as its current rate, historical changes, and how it compares to other pension schemes. By the end of this article, readers will be well-equipped to make informed decisions about their retirement planning and understand how the PMVVY interest rate can play a pivotal role in their financial security.

Read also:Rws Tours Your Ultimate Guide To An Unforgettable Experience

What is the Current PMVVY Interest Rate?

The PMVVY interest rate is set by the government and is subject to change every financial year. As of the latest update, the PMVVY interest rate stands at 7.4% per annum. This fixed rate ensures that senior citizens receive a guaranteed return on their investment, making it an attractive option for those looking for a secure source of income during their retirement years. The interest is payable monthly, thereby providing a steady cash flow to the beneficiaries.

How is the PMVVY Interest Rate Determined?

The determination of the PMVVY interest rate is influenced by several factors, including:

- Market interest rates

- Inflation rates

- Government policies and fiscal measures

- Economic conditions

Each financial year, the government reviews these factors to set the interest rate that will apply for that year. This systematic approach ensures that the rate remains competitive and relevant to the current economic landscape.

Is the PMVVY Interest Rate Fixed or Variable?

The PMVVY interest rate is fixed for the duration of the policy, which is 10 years. This means that once an individual invests in the scheme, they can expect to receive the same interest rate throughout the entire term. This fixed nature of the interest rate provides a level of certainty and predictability for retirees, allowing them to plan their finances effectively.

What are the Benefits of the PMVVY Interest Rate?

The PMVVY interest rate offers several benefits to senior citizens, including:

- Guaranteed returns that are unaffected by market fluctuations.

- Monthly payouts that can help manage living expenses.

- Financial security for retirees, ensuring a steady income stream.

- Tax benefits under Section 80C of the Income Tax Act.

These advantages make PMVVY an appealing choice for elderly individuals seeking a reliable source of income post-retirement.

Read also:Envision Definition Unraveling The Meaning And Applications

How Does PMVVY Compare to Other Pension Schemes?

When comparing the PMVVY interest rate to other pension schemes, it's essential to consider the following factors:

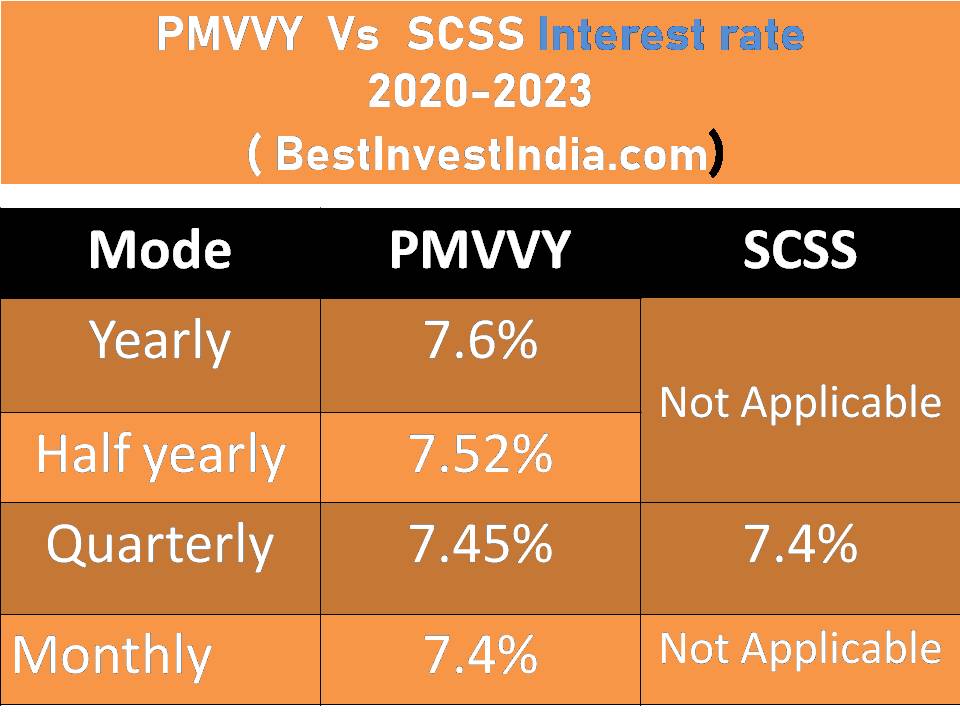

- Interest rates offered by other schemes, such as the Senior Citizens Savings Scheme (SCSS) or Fixed Deposits (FDs).

- The duration of the investment and the payout frequency.

- The level of risk associated with different schemes.

PMVVY stands out due to its government backing and fixed interest rate, providing a lower-risk option for seniors. However, individuals should evaluate their financial goals and risk tolerance before making any investment decisions.

What are the Eligibility Criteria for PMVVY?

To invest in PMVVY, individuals must meet the following eligibility criteria:

- The applicant must be at least 60 years old.

- The maximum investment limit is ₹15 lakhs per senior citizen.

- Both Indian citizens and Non-Resident Indians (NRIs) can apply.

These criteria ensure that the scheme is exclusively tailored for senior citizens, providing them with the financial assistance they need during their retirement years.

How to Apply for PMVVY?

The application process for PMVVY is straightforward. Interested individuals can follow these steps:

- Visit the official LIC website or any LIC branch.

- Obtain the PMVVY application form.

- Fill in the required details, including personal information and investment amount.

- Submit the completed form along with necessary documents, such as identity proof, age proof, and bank details.

Once the application is processed, beneficiaries will start receiving monthly payouts based on the PMVVY interest rate of their investment.

Conclusion: Is PMVVY the Right Choice for You?

In conclusion, the PMVVY interest rate plays a vital role in ensuring financial security for senior citizens. With its fixed returns, monthly payouts, and government backing, it is an attractive option for retirees looking to secure their future. However, individuals should assess their financial needs and explore various investment options before making a decision. By understanding the nuances of the PMVVY interest rate and its benefits, retirees can make informed choices that align with their financial goals.