When it comes to establishing a small business in India, the Prime Minister's Employment Generation Programme (PMEGP) offers an invaluable lifeline to aspiring entrepreneurs. However, many potential applicants often find themselves pondering the intricacies of the PMEGP loan approval time. Understanding this timeline is crucial for any entrepreneur looking to seize this financial opportunity. Navigating the loan application process can be daunting, and the uncertainty surrounding approval time can lead to frustration. This guide aims to clarify the various phases involved in the PMEGP loan approval process, shedding light on how long applicants can expect to wait and the factors that influence this timeline.

Many entrepreneurs are left questioning the viability of their business plans during the waiting period, which can significantly affect their startup momentum. The PMEGP loan approval time can vary based on a multitude of factors, including the completeness of the application, the applicant's financial history, and the workload of the approving authorities. By understanding these factors, applicants can better prepare themselves and potentially expedite their approval process.

In this article, we will delve into the various stages of the PMEGP loan approval process, including how to prepare your application, what to expect during the waiting period, and tips for ensuring a smoother experience. By the end of this guide, you'll have a clearer picture of the PMEGP loan approval time and how to navigate it efficiently.

Read also:Rivalry On The Court Baylor Vs Tcu Basketball Showdown

What is PMEGP?

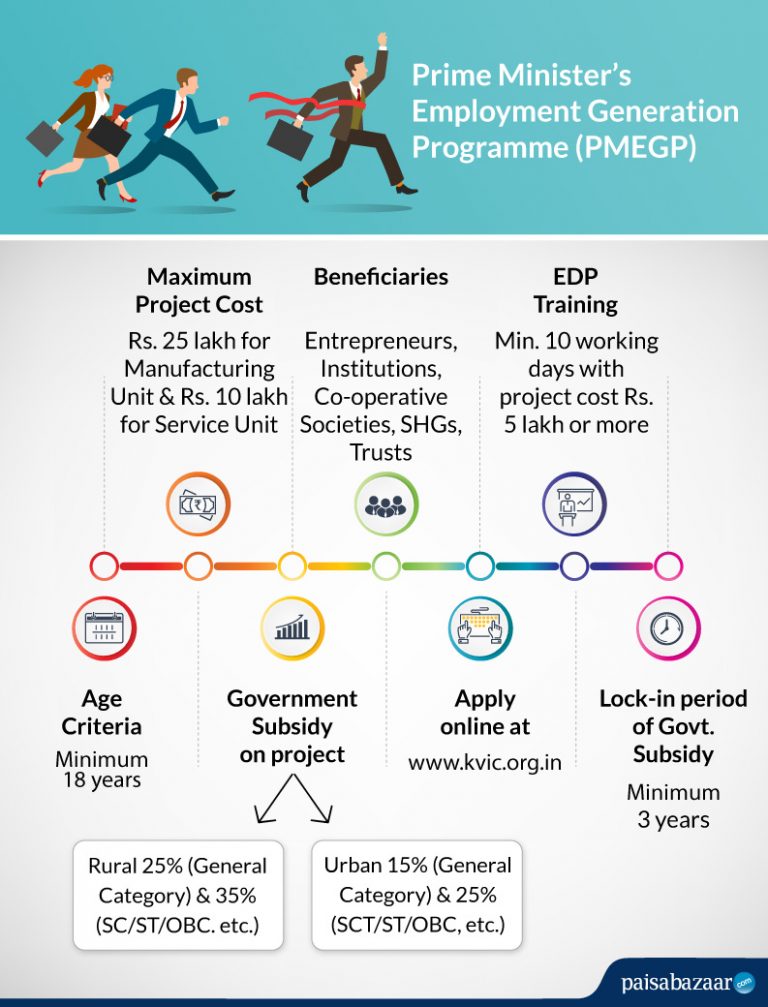

The Prime Minister's Employment Generation Programme (PMEGP) is a credit-linked subsidy scheme launched by the Government of India to promote self-employment through the establishment of small businesses. It aims to generate employment opportunities in rural and urban areas by providing financial assistance to new enterprises. The scheme is implemented by the Ministry of Micro, Small and Medium Enterprises (MSME) and is designed to provide a much-needed boost to aspiring entrepreneurs.

How Long Does PMEGP Loan Approval Take?

The PMEGP loan approval time can range from a few weeks to several months, depending on various factors. On average, applicants may expect a timeline of approximately 30 to 60 days for the entire approval process. However, this duration can be influenced by:

- The completeness and accuracy of the submitted application.

- The workload of the approving authorities.

- Any additional documentation required by banks or financial institutions.

- The applicant's credit history and financial standing.

What Factors Affect PMEGP Loan Approval Time?

Several factors can influence the PMEGP loan approval time, including:

- Application Completeness: An incomplete application can lead to delays as banks may require additional information.

- Documentation: The quality and accuracy of supporting documents can significantly impact the approval timeline.

- Bank Processing Time: Different banks have varying turnaround times for processing loan applications.

- Government Approvals: Some applications may require additional approvals from government bodies, which can extend the timeline.

What is the Application Process for PMEGP?

The application process for PMEGP involves several steps. Here's a brief overview:

- Preparation: Gather all necessary documents, including identity proof, address proof, and business proposals.

- Submission: Submit the application to the designated bank along with the required documents.

- Verification: The bank will conduct a preliminary review and verification of your application.

- Loan Sanction: If approved, the loan amount will be sanctioned, and you will receive a confirmation.

- Disbursement: The final step involves the disbursement of funds into your account.

How to Expedite PMEGP Loan Approval Time?

To enhance your chances of a quicker PMEGP loan approval time, consider the following tips:

- Ensure Completeness: Double-check your application for completeness and accuracy before submission.

- Follow Up: Maintain regular communication with the bank to stay updated on the status of your application.

- Prepare Thoroughly: Be ready to provide any additional information or documentation if requested by the bank.

- Choose the Right Bank: Research banks that are known for quicker processing times for PMEGP loans.

What Happens After Approval?

Once your PMEGP loan is approved, the next steps involve:

Read also:Charles Johnson A Deep Dive Into His Life And Contributions

- Documentation: Finalizing any remaining paperwork required by the bank.

- Fund Disbursement: The loan amount will be transferred to your designated account.

- Utilization: You should utilize the funds for the proposed business activities as outlined in your application.

Common Challenges Faced During PMEGP Loan Approval

Applicants may encounter various challenges during the PMEGP loan approval process, including:

- Documentation Issues: Missing or incorrect documents can lead to delays.

- Long Wait Times: The approval time may be longer than expected due to bureaucratic processes.

- Communication Barriers: Lack of clear communication with banks can create confusion.

Conclusion: Navigating PMEGP Loan Approval Time

Understanding the PMEGP loan approval time is vital for any entrepreneur looking to benefit from this government scheme. By being well-prepared, ensuring application completeness, and maintaining open communication with banks, applicants can streamline their approval process and reduce waiting times. Remember, patience and preparation are key in navigating the complexities of the PMEGP loan process.

In summary, the PMEGP loan approval time can vary considerably based on multiple factors, but with the right approach, it can be managed effectively. Whether you're a seasoned entrepreneur or a first-time applicant, being informed about the approval process can significantly impact your journey toward establishing a successful business.