The Pradhan Mantri Vaya Vandana Yojana (PMVVY) is a significant government initiative aimed at providing financial security to senior citizens in India. As we look ahead to 2024, understanding the PMVVY interest rate becomes crucial for prospective investors and beneficiaries alike. The scheme, which offers a steady income stream for retirees, has garnered considerable attention due to its attractive returns and government backing. In this article, we will delve into the PMVVY interest rate for 2024, its implications, and how it affects seniors looking for reliable investment options.

With the increasing cost of living and the need for financial independence, the PMVVY scheme stands out as a lifeline for many elderly individuals. The scheme allows seniors to invest their savings in a safe and secure manner, ensuring they can maintain their lifestyle without relying heavily on their families. As such, the interest rate set for 2024 will play a pivotal role in determining the attractiveness of this investment for the elderly population.

As we navigate through the financial landscape of 2024, it is essential to stay informed about any changes in the PMVVY interest rate. This will not only help investors make informed decisions but also aid in planning their retirement effectively. In the following sections, we will explore the current interest rate, its historical context, and what seniors can expect moving forward.

Read also:Delicious Delights At Dahlia Cafe Menu A Culinary Experience

What is PMVVY and How Does it Work?

The Pradhan Mantri Vaya Vandana Yojana (PMVVY) is a pension scheme launched by the Government of India specifically for senior citizens aged 60 years and above. This scheme offers a guaranteed return on investment, making it an appealing option for retirees seeking financial stability. Under PMVVY, individuals can invest a lump sum amount, which will then yield a fixed monthly pension over a specified period.

What are the Key Features of PMVVY?

- Age Requirement: Open to senior citizens aged 60 years and above.

- Investment Limit: The minimum investment is ₹1,50,000, and the maximum is ₹15,00,000.

- Tenure: The policy tenure is 10 years.

- Interest Rate: The interest rate for 2024 is a crucial factor in the scheme's attractiveness.

What is the PMVVY Interest Rate for 2024?

As of now, the exact PMVVY interest rate for 2024 has not been officially announced. However, the government typically reviews the interest rates on a quarterly basis, considering various economic factors. The interest rate is expected to be competitive, especially in comparison to other fixed-income investment options available in the market.

How is the PMVVY Interest Rate Determined?

The PMVVY interest rate is determined by the Ministry of Finance and is influenced by several factors, including:

- Current market interest rates

- Inflation rates

- Government policies regarding social security

- Demand for pension schemes among the elderly population

What are the Benefits of Investing in PMVVY?

There are multiple benefits associated with investing in PMVVY, particularly for senior citizens. These include:

- Guaranteed Returns: The scheme offers a fixed monthly income, ensuring financial stability.

- Government Backing: Since it is a government scheme, the risks are minimal.

- Tax Benefits: The investment qualifies for tax deductions under Section 80C of the Income Tax Act.

- Loan Facility: Investors can avail loans against their PMVVY policy after three policy years.

Are There Any Limitations to PMVVY?

While PMVVY offers numerous advantages, it is important to consider its limitations:

- The maximum investment limit may restrict high net-worth individuals.

- Liquidity is limited as the policy matures after 10 years.

- Partial withdrawal is not allowed.

How Does PMVVY Compare to Other Investments?

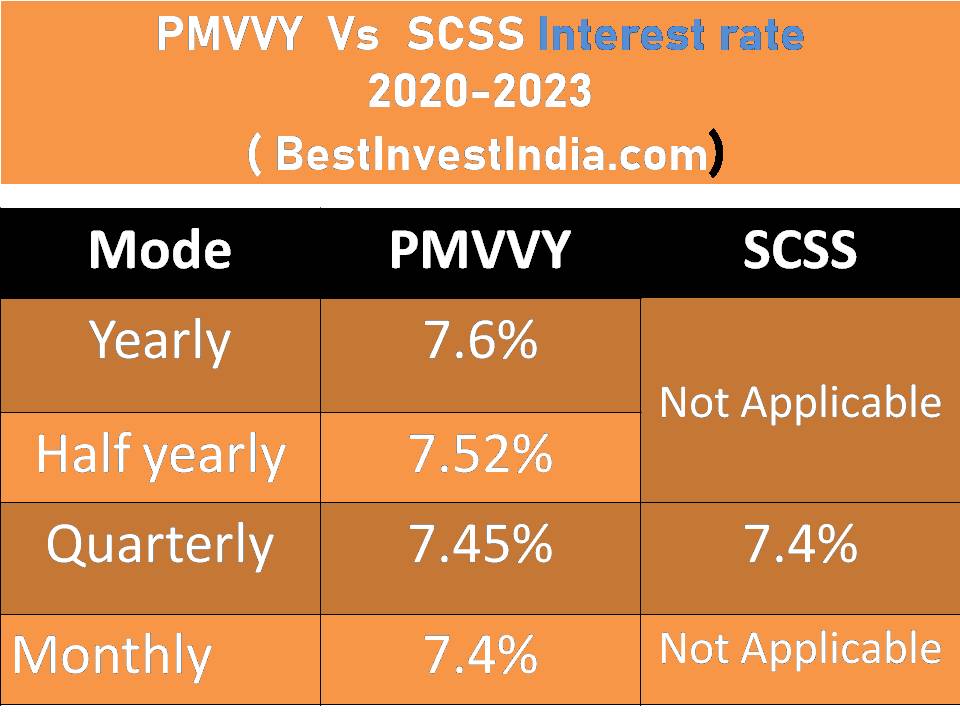

When comparing PMVVY to other fixed-income schemes, it is essential to evaluate the different interest rates, risk factors, and liquidity options. Here are some common alternatives:

Read also:Mastering The Art Of Logging Off A Guide To Digital Wellbeing

- Fixed Deposits: While offering competitive interest rates, they lack the pension benefit.

- Senior Citizens Savings Scheme (SCSS): Offers higher interest but with a lower investment cap.

- Public Provident Fund (PPF): Long-term investment with tax benefits but lower liquidity.

What Should Seniors Consider Before Investing in PMVVY?

Before making an investment decision, seniors should consider the following:

- Assess their financial needs and goals.

- Understand the interest rate implications for 2024.

- Consider the investment horizon and liquidity requirements.

- Seek advice from financial advisors if needed.

Conclusion: Is PMVVY Right for You in 2024?

In conclusion, the PMVVY interest rate for 2024 is a significant factor that will influence the decision-making process for many seniors. As we await the official announcement, it is vital for potential investors to weigh their options carefully, considering both the benefits and limitations of the scheme. With a government-backed guarantee and the promise of steady returns, PMVVY remains a compelling choice for those seeking financial security during retirement.

By staying informed about the evolving interest rates and market conditions, seniors can ensure they make the best possible financial decisions for their golden years.