The Prime Minister’s Employment Generation Programme (PMEGP) is a pivotal initiative aimed at promoting entrepreneurship and self-employment in India. For many aspiring entrepreneurs, obtaining a loan under this scheme can be a significant step towards realizing their business dreams. However, navigating the application process can sometimes be overwhelming, especially when it comes to accessing the right contact information for assistance. That’s where the PMEGP loan contact number plays a crucial role, serving as a direct line for guidance and support.

In this article, we will delve into the essentials of the PMEGP loan, exploring its benefits, the application process, and, most importantly, how to effectively reach out for help when you need it. Understanding the PMEGP loan contact number is not just about having a phone number; it’s about connecting with the resources that can empower your entrepreneurial journey. Whether you are a first-time applicant or looking to expand your existing business, knowing who to contact can make all the difference.

As we navigate through the various aspects of the PMEGP loan, we will answer commonly asked questions, provide tips on how to apply successfully, and highlight the significance of this loan in fostering economic growth and self-reliance among individuals. Let’s embark on this journey of discovery, ensuring that you have all the information you need at your fingertips, starting with the all-important PMEGP loan contact number.

Read also:Pat Flynn Inspiring Success Through Smart Passive Income Strategies

What is the PMEGP Loan?

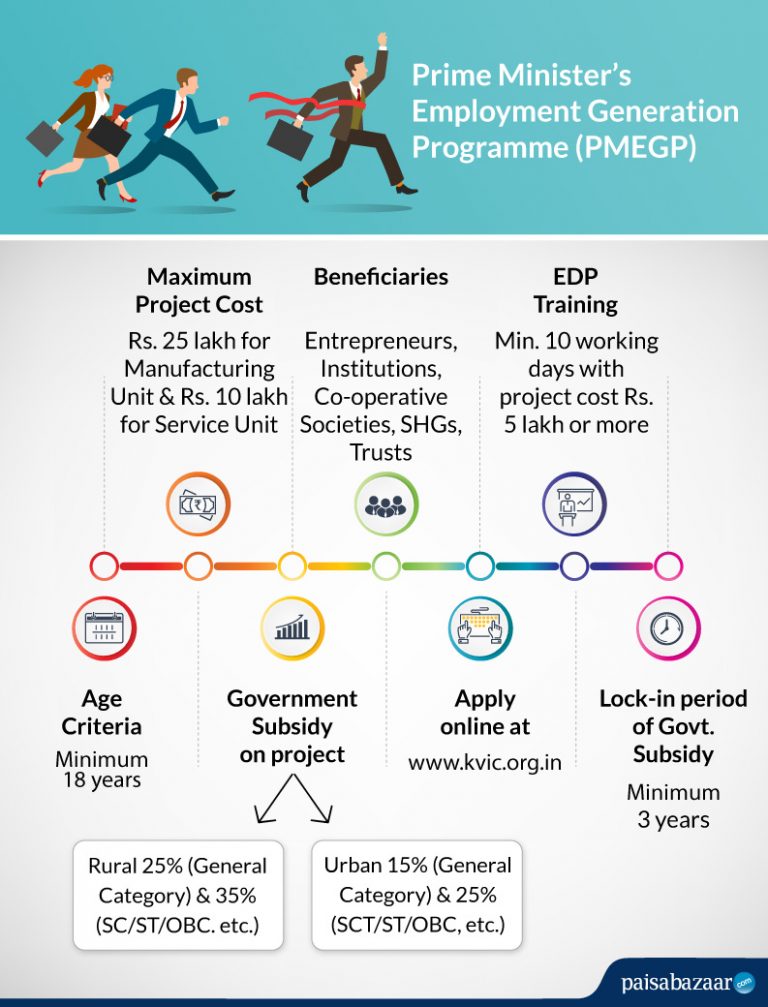

The Prime Minister’s Employment Generation Programme (PMEGP) is a credit-linked subsidy scheme initiated by the Government of India. It aims to promote self-employment through the establishment of micro-enterprises. Here are some key features:

- Targeted at new ventures and existing businesses looking for expansion.

- Provides financial assistance in the form of loans and subsidies.

- Encourages entrepreneurship among youth, women, and marginalized sections of society.

Who Can Apply for the PMEGP Loan?

The eligibility criteria for the PMEGP loan are designed to ensure that it reaches the intended beneficiaries. Here’s a breakdown:

- Individuals above the age of 18 can apply.

- Both new and existing enterprises are eligible.

- Special provisions are made for SC/ST, women, and differently-abled individuals.

How Much Loan Can You Get Under PMEGP?

The loan amount varies based on the category of the applicant:

- For general category applicants: Up to ₹25 lakh for manufacturing and ₹10 lakh for service sectors.

- For special category applicants (SC/ST, women, etc.): Up to ₹35 lakh for manufacturing and ₹15 lakh for service sectors.

What is the PMEGP Loan Contact Number?

Having access to the correct PMEGP loan contact number is essential for all applicants. This number connects you with the nodal agencies responsible for processing applications and providing guidance. To ensure you get the right assistance, here’s how to reach out:

- Visit the official website of the Ministry of MSME for updated contact details.

- You can also reach out to the nearest District Industries Centre (DIC).

- Contact numbers may vary by region; ensure you verify the local contact information.

How to Apply for the PMEGP Loan?

Applying for a PMEGP loan involves several steps:

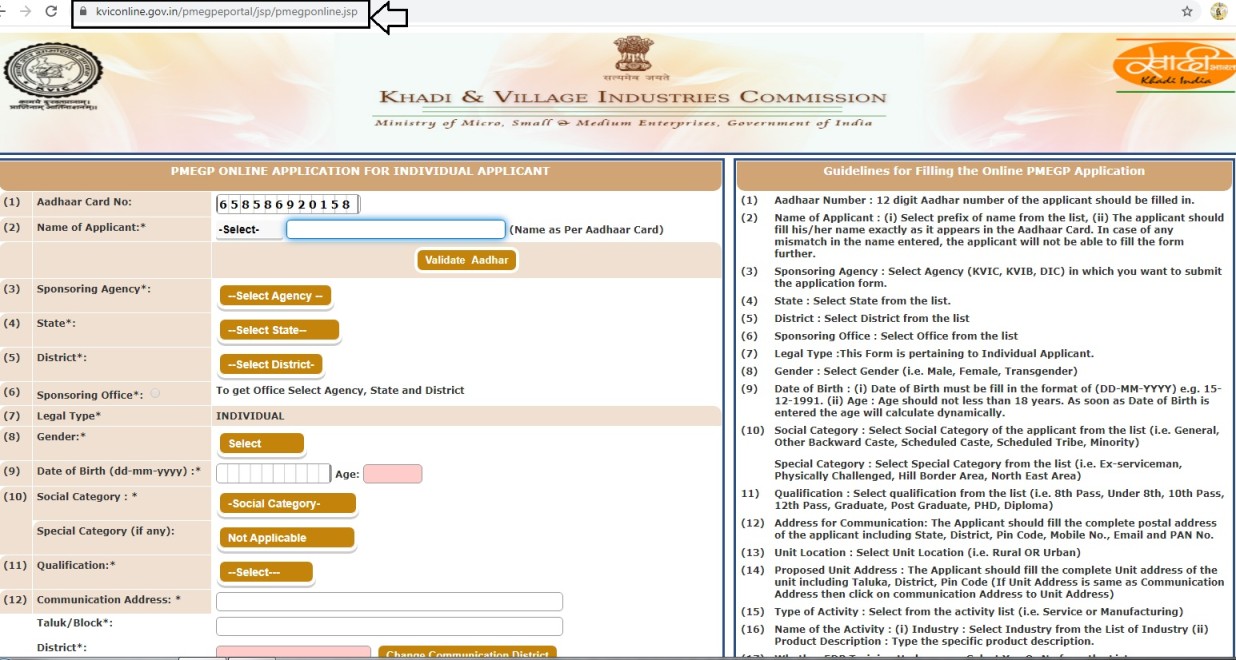

- Prepare a detailed project report that outlines your business idea.

- Visit the official PMEGP website or your local DIC for the application form.

- Submit the completed application along with necessary documents.

- Follow up using the PMEGP loan contact number for status updates.

What Documents Are Required for PMEGP Loan Application?

To apply for the PMEGP loan, you will need to submit several documents, including:

Read also:Parlay Meaning A Deep Dive Into Its Significance And Applications

- Aadhar card or any valid identification proof.

- Proof of address.

- Project report detailing the business plan.

- Bank account statement.

What Are the Benefits of the PMEGP Loan?

The PMEGP loan offers a myriad of benefits that extend beyond mere financial assistance:

- Subsidized interest rates make the loan affordable.

- Promotes the establishment of micro and small enterprises.

- Encourages skill development and self-employment.

How to Reach Out Using the PMEGP Loan Contact Number?

When you have questions or need assistance, here’s how to effectively reach out:

- Be prepared with your application details for a quicker response.

- Clearly state your queries or issues to ensure efficient communication.

- Keep a record of your interactions for future reference.

Where Can You Find the PMEGP Loan Contact Number?

The PMEGP loan contact number can be found on various platforms:

- The official website of the Ministry of Micro, Small, and Medium Enterprises (MSME).

- Your local District Industries Centre (DIC) or bank branch.

- Online forums and support groups for entrepreneurs.

Conclusion: Empower Your Business Journey with PMEGP

The PMEGP loan is not just about financial aid; it is a gateway to entrepreneurship and self-reliance. Knowing the PMEGP loan contact number is an essential tool that can facilitate your path to success. By understanding the application process, eligibility, and benefits, you can make informed decisions that will impact your business positively. As you embark on this journey, remember that help is just a call away—so don’t hesitate to reach out and unlock the opportunities that await you.