Are you an aspiring entrepreneur looking to kickstart your business journey in India? The Prime Minister's Employment Generation Programme (PMEGP) offers an excellent opportunity for small business owners to secure financial assistance. This government initiative aims to promote self-employment by providing loans to new and existing businesses. Understanding the PMEGP loan details can help you navigate the application process and maximize your chances of success.

The PMEGP scheme, launched by the Ministry of MSME, is specifically designed to empower individuals and create sustainable employment opportunities in the country. By offering financial support, the government encourages entrepreneurship and helps boost the economy. In this article, we will delve into the various aspects of PMEGP loans, including eligibility criteria, application procedures, and repayment terms, making it easier for you to access the funds you need to start or expand your business.

With the right knowledge about PMEGP loan details, you can take the first step towards achieving your entrepreneurial dreams. Whether you are planning to open a bakery, a retail store, or a service-oriented business, this guide will provide you with all the essential information you need to navigate the funding landscape successfully. So, let's explore the intricacies of the PMEGP loan and how it can pave the way for your business success.

Read also:Discovering The World Of Maine Listings A Comprehensive Guide

What is PMEGP?

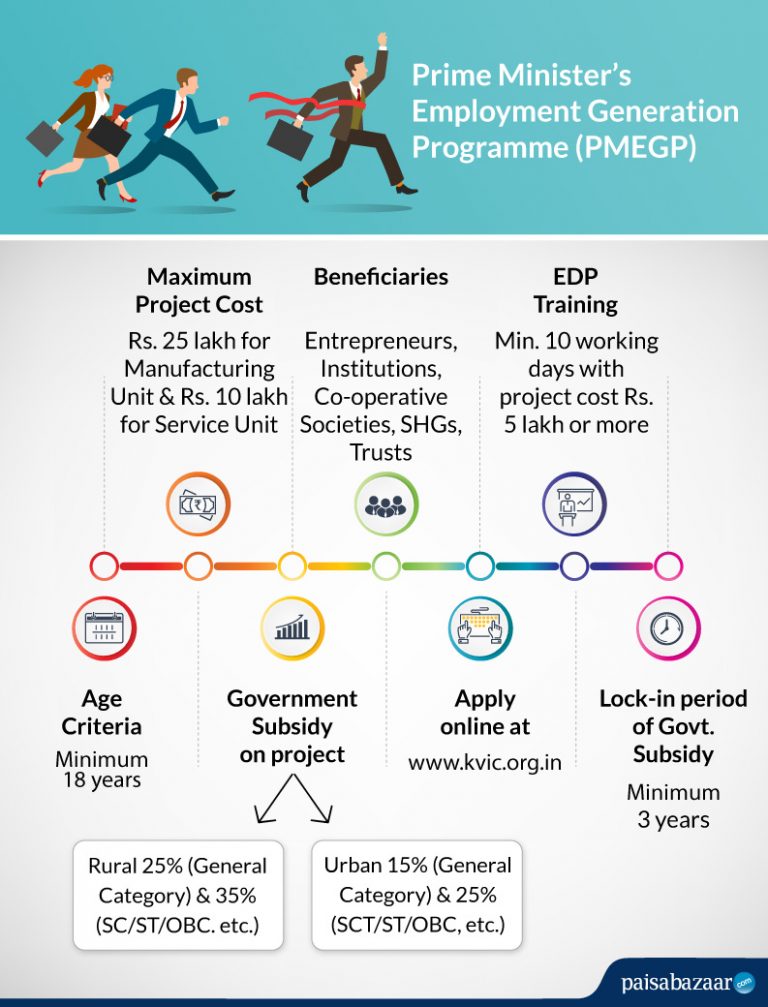

The Prime Minister's Employment Generation Programme (PMEGP) is a flagship scheme initiated by the Government of India to promote self-employment and entrepreneurship among individuals. It aims to generate sustainable employment opportunities in various sectors, enhancing the overall economic growth of the country. The scheme primarily focuses on providing financial assistance to new and existing enterprises, ensuring that aspiring entrepreneurs have the necessary support to turn their business ideas into reality.

What are the Key Features of PMEGP Loans?

- Financial Assistance: PMEGP offers loans ranging from INR 1 lakh to INR 25 lakhs, depending on the type of business.

- Subsidy Coverage: The scheme provides a subsidy of 15% to 35% on the project cost based on the location and category of the applicant.

- Repayment Period: The repayment period for PMEGP loans is typically 3 to 7 years, offering flexibility for borrowers.

- Single Window Clearance: The application process is streamlined through a single-window system, making it more accessible for entrepreneurs.

Who is Eligible for PMEGP Loans?

To avail of the PMEGP loan, applicants must meet certain eligibility criteria. These include:

- Individuals aged between 18 and 35 years.

- Applicants must possess a valid business idea or project report.

- Prior experience in the same business field is an added advantage.

- Both urban and rural applicants can apply for the scheme.

How to Apply for PMEGP Loans?

The application process for PMEGP loans is straightforward. Follow these steps to apply:

- Prepare a detailed project report outlining your business idea and financial requirements.

- Visit the nearest Khadi and Village Industries Commission (KVIC) or District Industries Centre (DIC) office.

- Submit the application form along with the project report and necessary documents.

- Wait for the assessment and approval from the concerned authorities.

What Documents are Required for PMEGP Loan Application?

When applying for the PMEGP loan, you need to submit several documents, including:

- Identity proof (Aadhaar card, voter ID, etc.)

- Address proof (utility bills, rental agreements, etc.)

- Educational qualifications and experience certificates.

- Project report detailing the business plan and funding requirements.

What is the Repayment Process for PMEGP Loans?

The repayment of PMEGP loans is structured to ease the financial burden on borrowers. Here are some key points regarding the repayment process:

- EMIs can be paid monthly or quarterly, depending on the borrower's convenience.

- Interest rates are competitive, making it easier to manage repayments.

- Borrowers can apply for a moratorium period if they face temporary financial challenges.

What are the Benefits of PMEGP Loans?

The PMEGP scheme offers numerous advantages, making it an attractive option for budding entrepreneurs:

Read also:Miami Dolphins Vs Buffalo Bills A Rivalry Like No Other

- Boosts Entrepreneurship: Provides the necessary financial support to start and grow businesses.

- Job Creation: Contributes to employment generation, reducing unemployment rates.

- Government Backing: Loans are backed by government guarantees, reducing the risk for lenders.

- Encourages Innovation: Supports diverse business ideas and encourages innovation in various sectors.

Are There Any Challenges in Obtaining PMEGP Loans?

While PMEGP loans offer significant benefits, there can be challenges in the application process:

- Documentation: Gathering the required documents can be time-consuming.

- Approval Timeline: The loan approval process may take longer than expected due to bureaucratic procedures.

- Awareness: Many potential applicants may not be aware of the scheme or its benefits.

Conclusion: Is PMEGP the Right Choice for You?

In conclusion, understanding the PMEGP loan details is crucial for anyone looking to start or expand their business in India. With its various features, benefits, and a straightforward application process, PMEGP serves as a valuable resource for aspiring entrepreneurs. By leveraging this scheme, you can turn your business dreams into reality and contribute to the economic development of the country.

If you are ready to take the plunge into entrepreneurship, consider applying for a PMEGP loan today and unlock the potential of your business idea!