In today's fast-paced world, having quick access to funds can be a game-changer. Whether it's for unexpected medical expenses, home repairs, or simply to consolidate debt, a reliable loan option is essential for many individuals. That's where the UnionBank quick loan comes into play, catering to the urgent financial needs of its clients. This innovative financial product offers a seamless application process, ensuring that you can secure the funds you need without unnecessary delays.

UnionBank has established itself as a leader in the banking sector, known for its commitment to customer service and innovative financial solutions. The UnionBank quick loan is designed to empower customers with fast, hassle-free access to funds, allowing them to tackle their financial challenges head-on. With competitive interest rates and flexible terms, this loan option is tailored to meet the diverse needs of borrowers, making it a go-to choice for many.

In this article, we will explore the ins and outs of the UnionBank quick loan, answering common questions and providing insights into how you can leverage this financial tool to achieve your goals. From eligibility requirements to application processes, we aim to equip you with all the information you need to make informed decisions about your financial future.

Read also:Weather Patterns And Climate In Kent Wa A Detailed Guide

What is the UnionBank Quick Loan?

The UnionBank quick loan is a personal loan product designed to provide borrowers with fast access to funds. This loan is ideal for individuals who require immediate financial assistance without the lengthy approval processes typically associated with traditional loans. With a user-friendly online application, UnionBank makes it easy for customers to apply and receive their funds promptly.

How Does the Application Process Work?

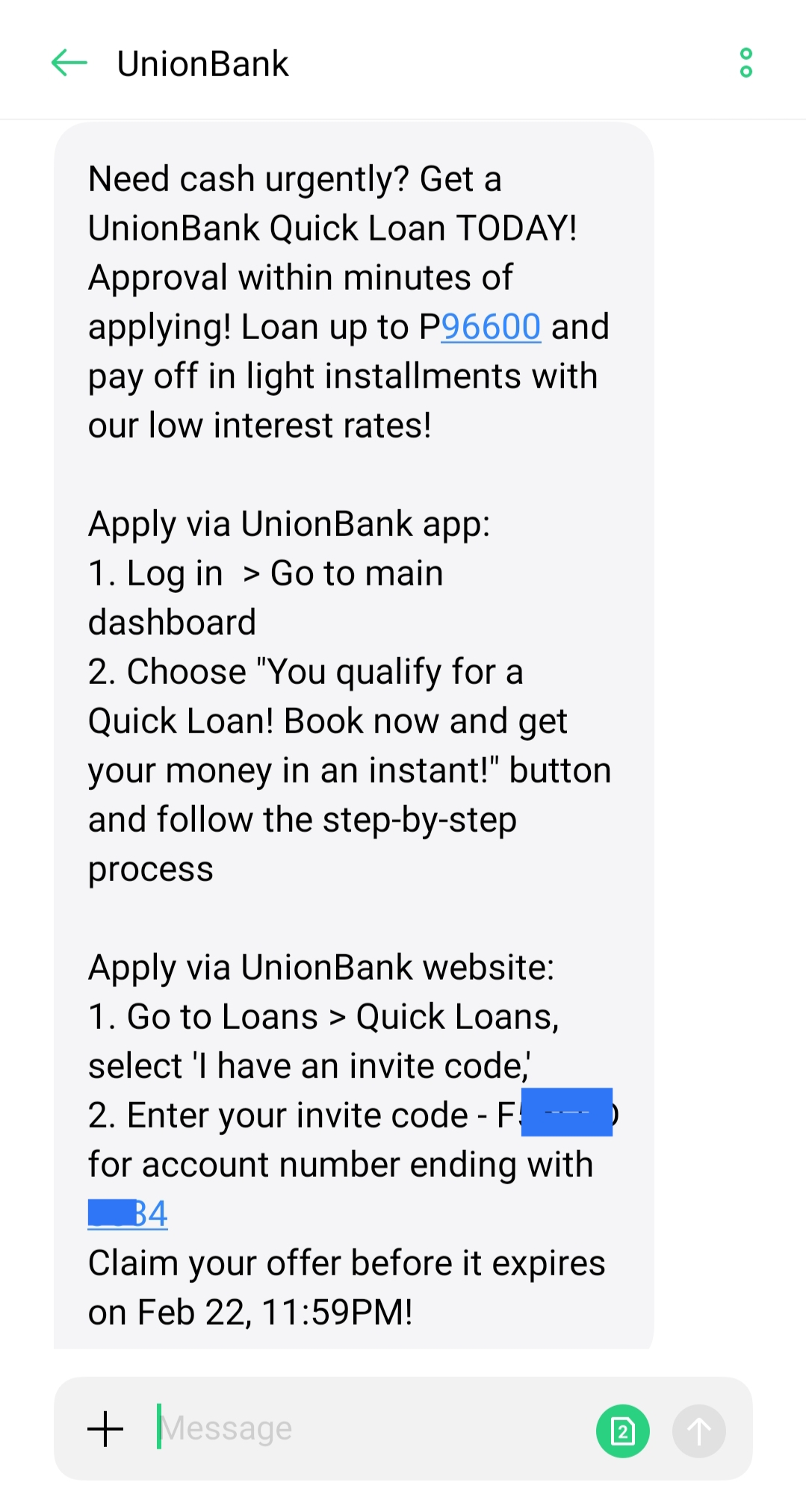

Applying for the UnionBank quick loan is a straightforward process that can be completed in just a few simple steps:

- Visit the UnionBank website or mobile app.

- Fill out the online application form with the required information.

- Submit the necessary documents, such as identification and income proof.

- Receive approval notification and funds disbursement within a short period.

What Are the Eligibility Requirements?

To qualify for the UnionBank quick loan, applicants must meet certain eligibility criteria, which may include:

- Must be a Filipino citizen or a legal resident.

- Must be at least 21 years old and not more than 65 years old at the time of application.

- Must have a stable source of income.

- Must have a good credit history.

What Are the Benefits of the UnionBank Quick Loan?

The UnionBank quick loan comes with numerous benefits that make it an attractive option for borrowers. Some of these benefits include:

- Fast approval and disbursement of funds.

- Competitive interest rates.

- Flexible repayment terms.

- Convenient online application process.

How Much Can You Borrow with UnionBank Quick Loan?

The amount you can borrow through the UnionBank quick loan varies based on your income and credit profile. Generally, borrowers can access loans ranging from a few thousand pesos up to several hundred thousand pesos. This flexibility allows you to choose a loan amount that fits your specific needs.

Can You Use the UnionBank Quick Loan for Any Purpose?

One of the appealing aspects of the UnionBank quick loan is that it can be used for various purposes, including but not limited to:

Read also:Duskmourn Prerelease A Comprehensive Guide To The Event

- Medical expenses

- Home improvements

- Debt consolidation

- Travel and leisure

What Are the Risks of Taking Out a Quick Loan?

While the UnionBank quick loan offers many advantages, it's essential to consider the potential risks involved. Borrowers should be cautious about:

- High-interest rates if the loan is not repaid on time.

- The temptation to borrow more than necessary.

- Impact on credit score if payments are missed.

How to Make the Most of Your UnionBank Quick Loan?

To maximize the benefits of your UnionBank quick loan, consider the following tips:

- Borrow only what you need to minimize interest payments.

- Create a repayment plan to ensure timely payments.

- Monitor your expenses to avoid falling into debt.

Conclusion: Is the UnionBank Quick Loan Right for You?

In conclusion, the UnionBank quick loan is a valuable financial tool for individuals seeking immediate funding. With its easy application process, competitive rates, and flexible terms, it can help you navigate your financial challenges effectively. However, it's crucial to assess your financial situation and borrowing needs carefully before committing to any loan. By understanding the benefits and risks associated with the UnionBank quick loan, you can make an informed decision that aligns with your financial goals.