When it comes to managing finances, understanding your loan obligations is crucial. Whether you are a first-time borrower or a seasoned loan taker, keeping track of your IDFC loan payment can help you maintain a sound financial status. IDFC First Bank offers a variety of loan products, and knowing how to efficiently handle your payments will ensure a smooth borrowing experience. This guide is designed to provide you with essential information about IDFC loan payments, including payment methods, tips for timely payments, and frequently asked questions.

In today’s busy world, making timely loan payments can often feel daunting. However, with the right tools and information, managing your IDFC loan payment can become a straightforward task. This guide aims to simplify the process for you, ensuring that you have the knowledge needed to stay on track with your payments. From understanding the payment schedule to utilizing various payment options offered by IDFC First Bank, we will cover all aspects of your loan payment journey.

Understanding the importance of timely loan payments is key to maintaining a positive credit score and avoiding penalties. Late payments can lead to additional charges and affect your overall financial health. Therefore, it is essential to stay informed about your IDFC loan payment details and proactively manage your loan. Let’s delve into the specifics of IDFC loan payments, ensuring you are equipped with the necessary information to succeed.

Read also:Timely Access To In N Out Hours Maximizing Your Experience

What is IDFC Loan Payment?

IDFC loan payment refers to the process by which borrowers repay the loans they have taken from IDFC First Bank. This includes various types of loans such as personal loans, home loans, and vehicle loans. Each loan type comes with its own repayment terms, interest rates, and payment schedules. Understanding these details is essential for borrowers to manage their finances effectively.

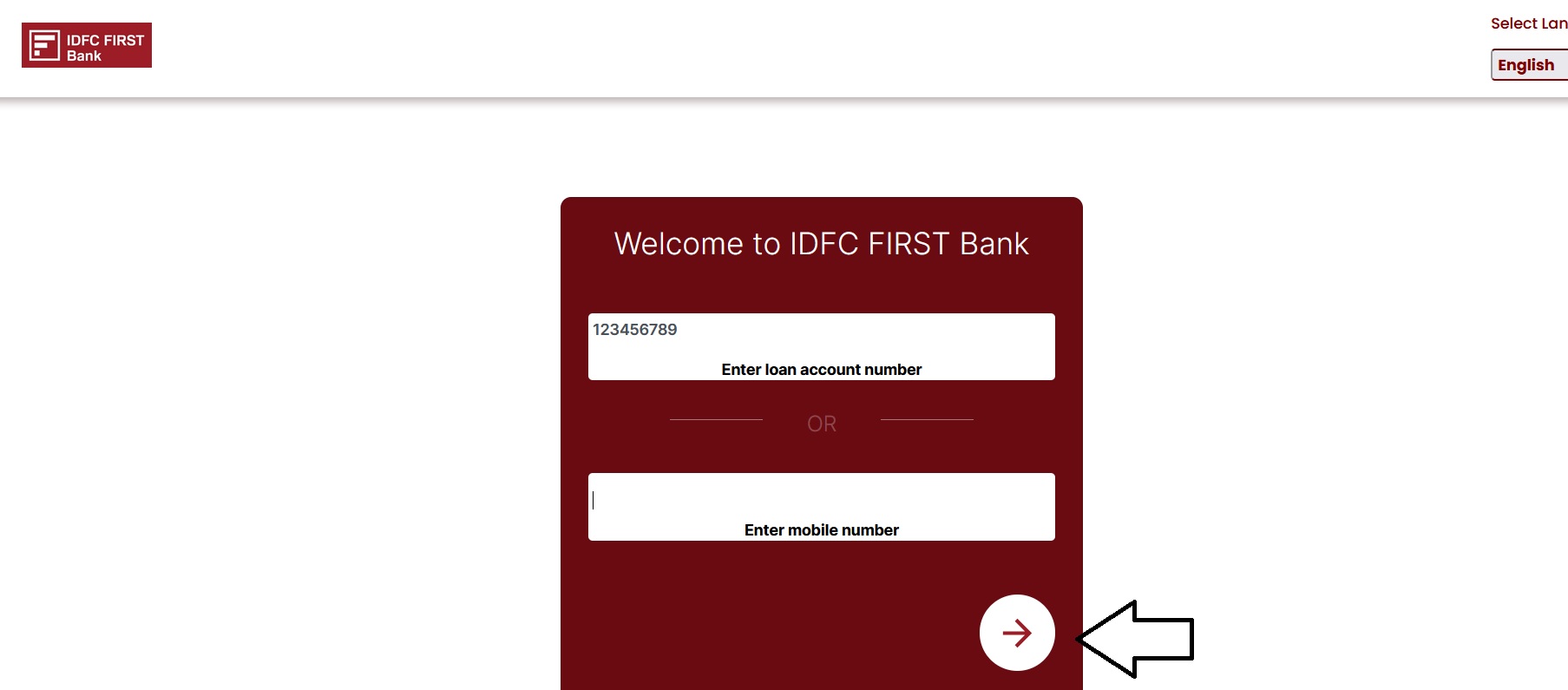

How to Make an IDFC Loan Payment?

Making an IDFC loan payment can be done through various methods. Here are some common ways to pay your IDFC loan:

- Online Payment through Net Banking

- Mobile Banking App

- NEFT or RTGS Transfer

- Cheque Payment at Bank Branch

- Auto-Debit Facility

Each of these methods offers convenience and flexibility to borrowers, allowing them to choose the one that best fits their lifestyle.

Can I Set Up Auto-Debit for My IDFC Loan Payment?

Yes, IDFC First Bank offers an auto-debit facility for loan payments. This feature allows borrowers to set up automatic deductions from their bank accounts on the due date. This is a great way to ensure timely payments and avoid late fees.

What Happens If I Miss an IDFC Loan Payment?

Missing an IDFC loan payment can have several consequences, including:

- Late Payment Fees

- Increased Interest Rates

- Negative Impact on Credit Score

- Legal Actions in Severe Cases

To avoid these repercussions, it is vital to stay on top of your payment schedule and communicate with the bank if you foresee any issues in making a payment.

Read also:Mastering The Art Of Logging Off A Guide To Digital Wellbeing

What Are the Benefits of Timely IDFC Loan Payments?

Making timely IDFC loan payments comes with numerous benefits, such as:

- Improvement of Credit Score

- Eligibility for Future Loans

- Improved Relationship with the Bank

- Possibility of Lower Interest Rates on Future Loans

These advantages highlight the importance of maintaining a good repayment record.

How to Check My IDFC Loan Payment Status?

Borrowers can easily check their IDFC loan payment status through:

- IDFC First Bank Mobile App

- Net Banking Portal

- Customer Care Helpline

These channels provide real-time updates on payment status and outstanding amounts.

Is There a Grace Period for IDFC Loan Payments?

IDFC First Bank does not typically offer a grace period for loan payments. Therefore, borrowers are advised to make payments on time to avoid any penalties or negative repercussions.

What Should I Do If I Can’t Make My IDFC Loan Payment?

If you find yourself unable to make your IDFC loan payment, consider the following steps:

- Contact IDFC First Bank Customer Service

- Discuss Possible Restructuring Options

- Explore Temporary Financial Assistance Programs

Taking action quickly can help mitigate the impact of late payments.

Conclusion: Taking Charge of Your IDFC Loan Payment

Managing your IDFC loan payment effectively is essential for your financial well-being. By understanding the payment process, utilizing available tools, and maintaining communication with the bank, you can ensure that your loan obligations are met. Always prioritize timely payments to enjoy the benefits that come with responsible borrowing. Whether you are seeking to build your credit score or simply want to maintain a good relationship with your bank, staying informed about your IDFC loan payment will set you on the path to success.