The gold market has always been a focal point for investors and traders alike. Understanding the gold rate graph in 2024 is essential for making informed decisions in a volatile economic landscape. As we step into this new year, many are curious about the potential fluctuations and trends that will shape the market. With global uncertainties and changing economic conditions, the price of gold is expected to see various influences that could affect its trajectory.

In recent years, gold has proven to be a safe haven for investors during times of uncertainty. The gold rate graph in 2024 will reflect the impact of various factors such as inflation, interest rates, and geopolitical tensions. As we analyze the historical data and current trends, it becomes evident that understanding these dynamics is crucial for anyone looking to invest in gold.

The year 2024 is poised to present unique opportunities and challenges for gold investors. Whether you are a seasoned trader or a newcomer to the gold market, keeping an eye on the gold rate graph will provide valuable insights into market direction. This article will delve into the factors influencing gold prices, expected trends, and how you can navigate this landscape effectively.

Read also:Delightful Adventures In The Outer Banks Your Ultimate Guide

What Factors Influence Gold Prices in 2024?

The gold market is influenced by a myriad of factors that can lead to fluctuations in prices. Here are some key elements to consider:

- Economic Indicators: Inflation rates, employment rates, and GDP growth all play a crucial role in determining gold prices.

- Geopolitical Events: Political instability and conflicts can drive investors towards gold as a safe haven.

- Central Bank Policies: Decisions made by central banks regarding interest rates can have a direct impact on gold prices.

- Currency Strength: The value of the US dollar, in particular, has an inverse relationship with gold prices.

How Can Investors Read the Gold Rate Graph in 2024?

Understanding how to read the gold rate graph is essential for making informed investment decisions. Here are some tips:

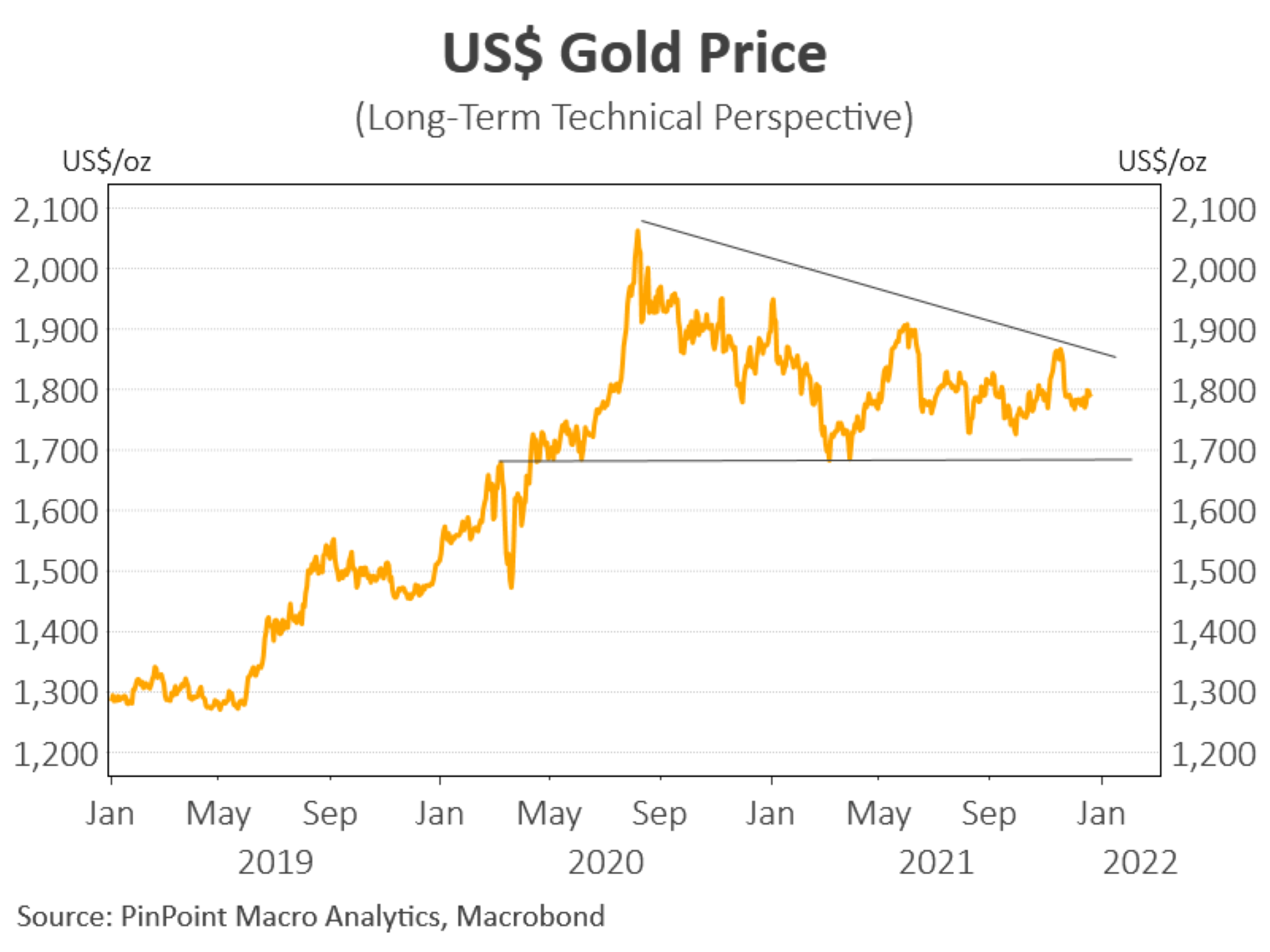

- Identify Trends: Look for patterns in the graph to determine whether prices are trending upward or downward.

- Analyze Volume: High trading volumes can indicate strong investor interest, which may affect price movement.

- Use Technical Indicators: Employ tools such as moving averages or RSI to predict future price movements.

What Are the Predictions for Gold Prices in 2024?

Various analysts and financial experts have made predictions regarding gold prices in 2024. While it is impossible to accurately forecast prices, some common expectations include:

- Gradual Increase: Many predict a gradual increase in gold prices due to ongoing inflation concerns.

- Volatility: Increased market volatility may lead to short-term fluctuations in gold prices.

- Long-term Growth: Overall, a general bullish sentiment is expected as more investors turn to gold as a hedge against economic uncertainty.

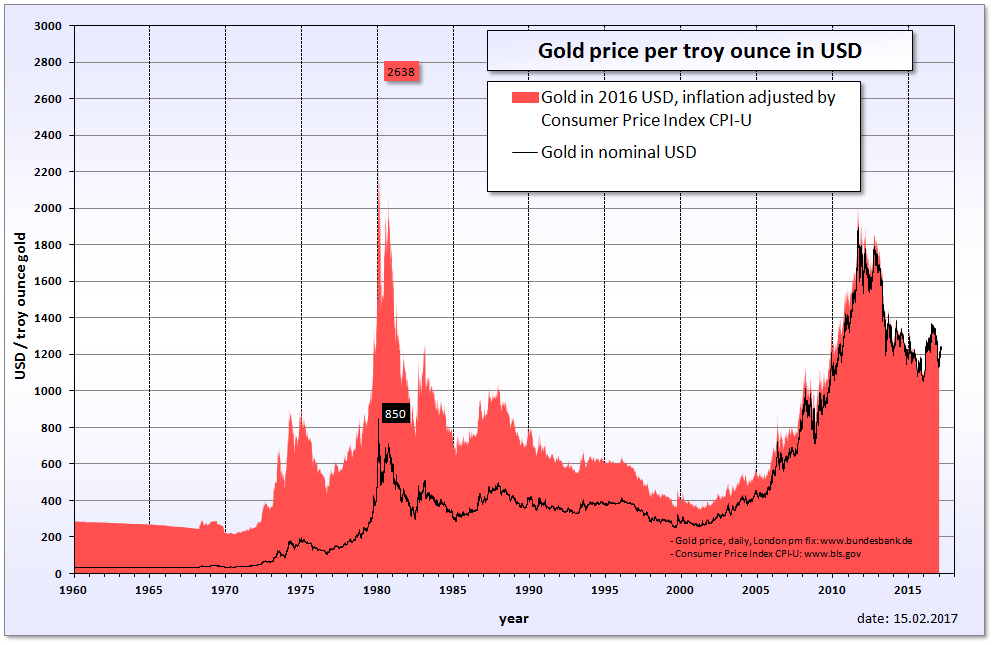

What Historical Data Can Help Us Understand the Gold Rate Graph in 2024?

To better understand the gold rate graph in 2024, it is essential to analyze historical data. Here are some key points to consider:

- Price Trends: Reviewing historical price trends can provide insights into expected price movements.

- Previous Economic Events: Examining how gold prices responded during previous economic crises can offer valuable lessons.

- Market Sentiment: Understanding how market sentiment has shifted in the past can help in predicting future reactions.

How Do Global Events Impact the Gold Rate Graph in 2024?

Global events can significantly impact the gold market. Some events to watch for in 2024 include:

- Trade Wars: Ongoing trade disputes can lead to uncertainty, increasing demand for gold.

- Political Elections: Major elections may create volatility in markets, influencing gold prices.

- Natural Disasters: Events such as earthquakes or pandemics can disrupt economies and drive investors towards gold.

What Strategies Can Investors Use to Navigate the Gold Market in 2024?

As the gold market continues to evolve, investors must adapt their strategies. Here are some effective approaches:

Read also:My Niu Your Comprehensive Guide To Understanding And Maximizing Its Potential

- Diversification: Don't put all your eggs in one basket; diversify your investment portfolio to mitigate risks.

- Stay Informed: Keep abreast of market news and trends to make timely decisions.

- Set Goals: Establish clear investment goals and stick to them to stay focused in a fluctuating market.

Conclusion: Preparing for the Gold Rate Graph in 2024

As we prepare for the gold rate graph in 2024, it is crucial to understand the underlying factors that will influence prices. By keeping a close eye on economic indicators, geopolitical events, and market sentiment, investors can make informed decisions. Whether you're looking to invest in physical gold, ETFs, or mining stocks, having a strategic approach will be essential. The gold market may be unpredictable, but with the right knowledge and tools, you can navigate it successfully.